Fraud can happen to anytime anywhere. How can predictive analytics help businesses curb them. Find out!

Introduction

We often hear that "data is the new gold" in the modern age, and it’s abundantly available. But with its immense value, it’s no surprise that some may attempt to misuse it. Can we completely prevent such misuse? Probably not. However, we can detect it early and take proactive steps to minimize its impact. In this blog, we'll explore how modern data analytics can help reduce fraudulent financial activities, protecting both businesses' finances and their reputations. Let’s dive in!

What is Online Fraud

An activity/transaction, conducted online with the intent to steal identity, make illegal financial transactions, use stolen credit/debit cards to buy products and many more. Today, where every industry is loaded with crucial data, online fraud can happen anywhere, be it financial, health, supply chain, retail and many more.

What has changed

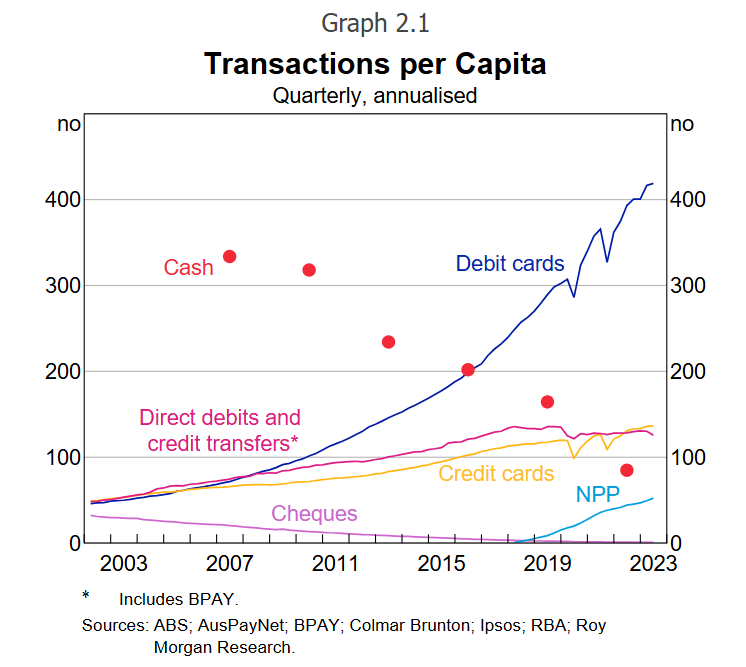

Technology is changing and evolving at the speed of knots, not our ability to prevent fraudsters to perform illegal activities. The world is going digital, with over 90% transactions in Australia going cashless. The graph below (Graph 2.1) shows the steep rise of digital payments (especially debit and credit cards) over the period of 2 decades. This is supported by improved and efficient internet infrastructure and technology rollout to accept digital payments to almost every vendor in Australia.

The above chart describes the rise of cashless economy and the decline in usage of cash . These tell us a lot about consumer behaviour not just in volume of transactions but also value of transactions.

How much fraud is happening

It shows that Australians made over 601,000 scam reports to organisations in 2023, an 18.5 per cent increase on 2022. In terms of financial losses, investment scams continued to cause the most harm ($1.3 billion), followed by remote access scams ($256 million) and romance scams ($201.1 million). With scam activity on the rise globally in recent years, the report highlights the impact of targeted and coordinated disruption activities across government, industry, law enforcement and community organisations, leading to lower overall financial losses.

*Source: ACCC

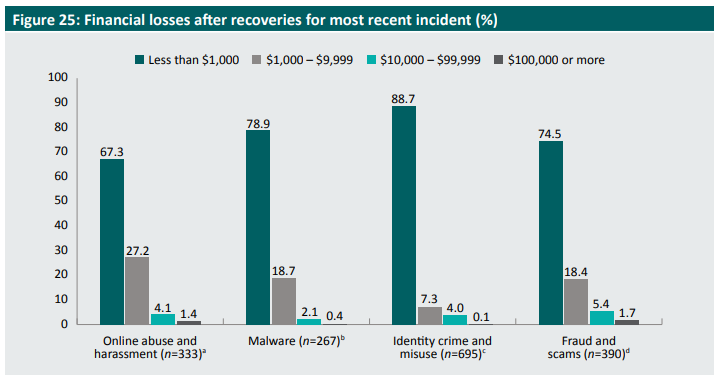

The results presented in this section show that individual losses associated with cybercrime victimisation vary widely. Most report losing no money from the most recent incident. Among those victims who do lose money and who could report how much, the majority lose less than $1,000. For some individuals, this may have little impact on their lives. For others, the impact may be substantial.

What is apparent from these results is that cybercrime is most frequently a high-volume, low-yield crime. While the methodology used in this survey does not allow for the results to be extrapolated to the wider community, the high rate of victimisation means that, even with the relatively small median losses per victim, the overall cost to Australian individuals is likely to be enormous.

Role of Predictive analytics in Fraud Management

Predictive analytics is a sophisticated approach to fraud prevention that utilizes data, statistical algorithms, and machine learning techniques to identify the likelihood of future outcomes based on historical data analytics. At its core, predictive analytics is about anticipating unknown future events, and in the context of fraud prevention, it plays a crucial role in identifying and mitigating potential fraudulent activities before they occur.

Using historical data analytics and user behaviour, predictive models discern patterns indicative of fraud. For example, a model trained on datasets marked with fraud instances learns to recognize and flag similar patterns in new incidents, whether they be in call logs, frequencies, or unusual user behaviours.

The true strength of predictive analytics lies in its continuous learning ability. By leveraging AI and machine learning, these models can constantly evolve and adapt, learning from past successes and failures to refine their detection capabilities, ensuring they remain effective even as fraudsters develop new tactics, staying one step ahead of the evolving threat landscape.

Using Predictive Analytics with BI Reporting

Imagine the ability to see probable fraudulent actions that can happen in future, and ability to slice and dice your data to see the consumer data, products, sellers etc all in a single report (Imagine your data set here). How powerful that reporting can be to prevent unwanted business losses, streamline business strategies and preserve business image in the market.

When businesses think this can't be achieved, or this is too difficult or it is too expensive of our business, we say TRY US! We will sit down with you and workout all the above issues to give your business the real power of data.